ReBloom is the leading technology infrastructure for private market secondaries for institutional investors in pre-IPO companies.

Private Market Secondaries Dark Pool

The Technology Infrastructure for Institutional Players in Private Markets

Built by Venture Capital Secondaries Experts

Live Supply and Demand

$6B+

Institutional Clients

150+

Average Transaction Size

$20M+

Dark Pool for Institutionals

Because institutional investors need discretion. ReBloom offers fully anonymous and unmatched confidentiality for secondary transactions.

- Invite-only. Listings and Demand Handled Off-Market

- Live Supply and Demand in Most Sought After Assets

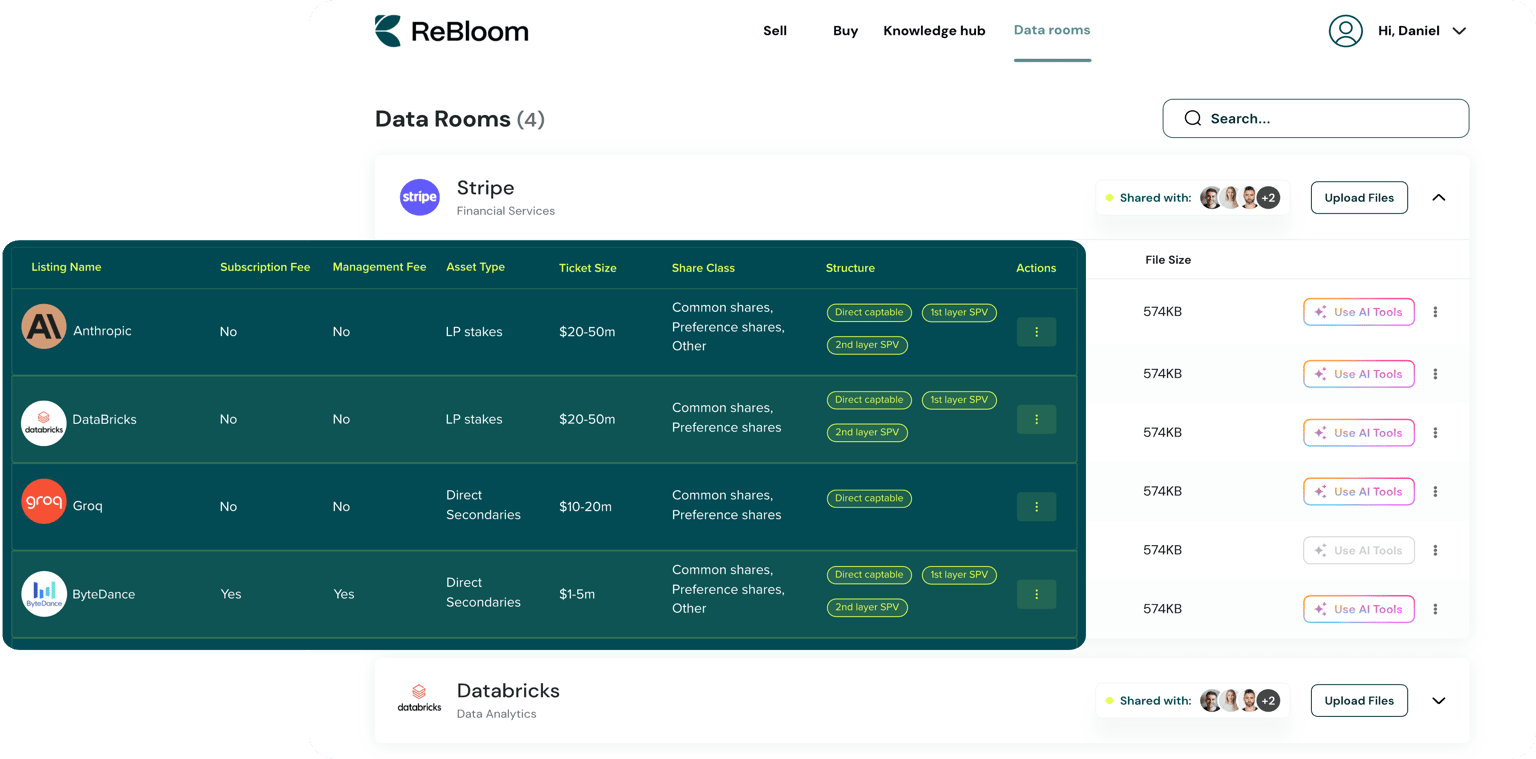

- Data Rooms with Granular Access Control

- Industry first AI Assisted Due Diligence

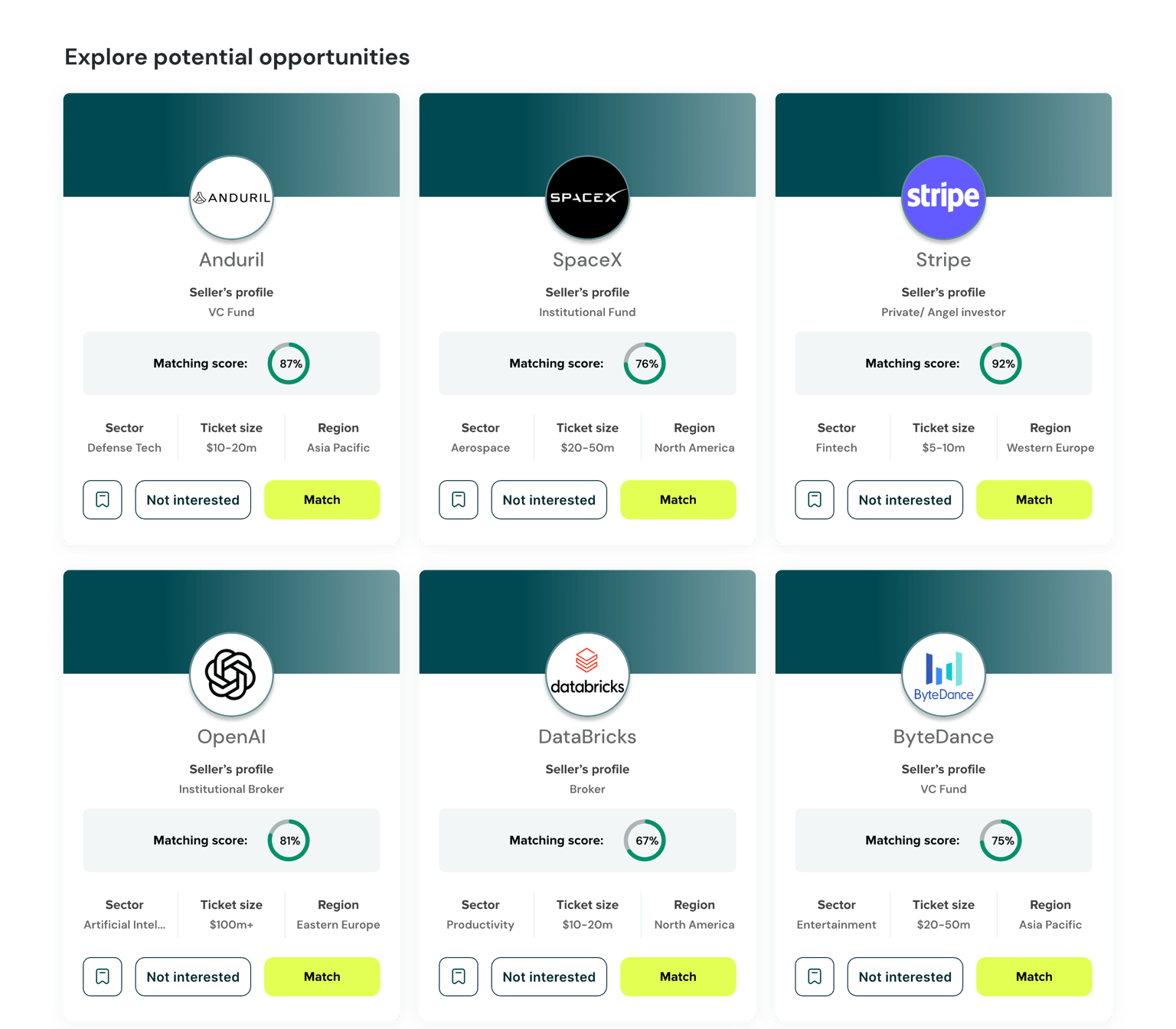

- AI-Enabled Anonymous Matching

End-to-End Coverage for Private Market Secondaries

Sourcing, Due Diligence, Transaction

HOW REBLOOM WORKS

Intelligent Platform for Private Investments

ReBloom offers an intelligent and AI-enabled platform for Private Market Secondaries offering tools and services like AI-enabled Dynamic Matching of Investors, Waterfall Simulation Models, Comps Analysis, Market Reports, AI-enabled Document Analysis, and Dark Pool Environments for Maximal Confidentiality.

AI for Documents

ReBloom's suite of industry-first AI tools for private market secondary transactions is handling the complexities of due diligence processes for institutional investors.

- Our Agentic AI tools identify and extract key investment parameters and clauses spanning Multiple Share Classes with Seniority, Liquidation Preferences, ROFR, Hurdle Rates, Anti-Dilution, Pre-Emption Rights, and more.

- Our Cap table AI tools visualize distributions of ownership and provides analysis of ownership structures.

- Our tools work for Share Holder's Agreements, Articles of Associations, Pitch Decks, Cap tables, and more.

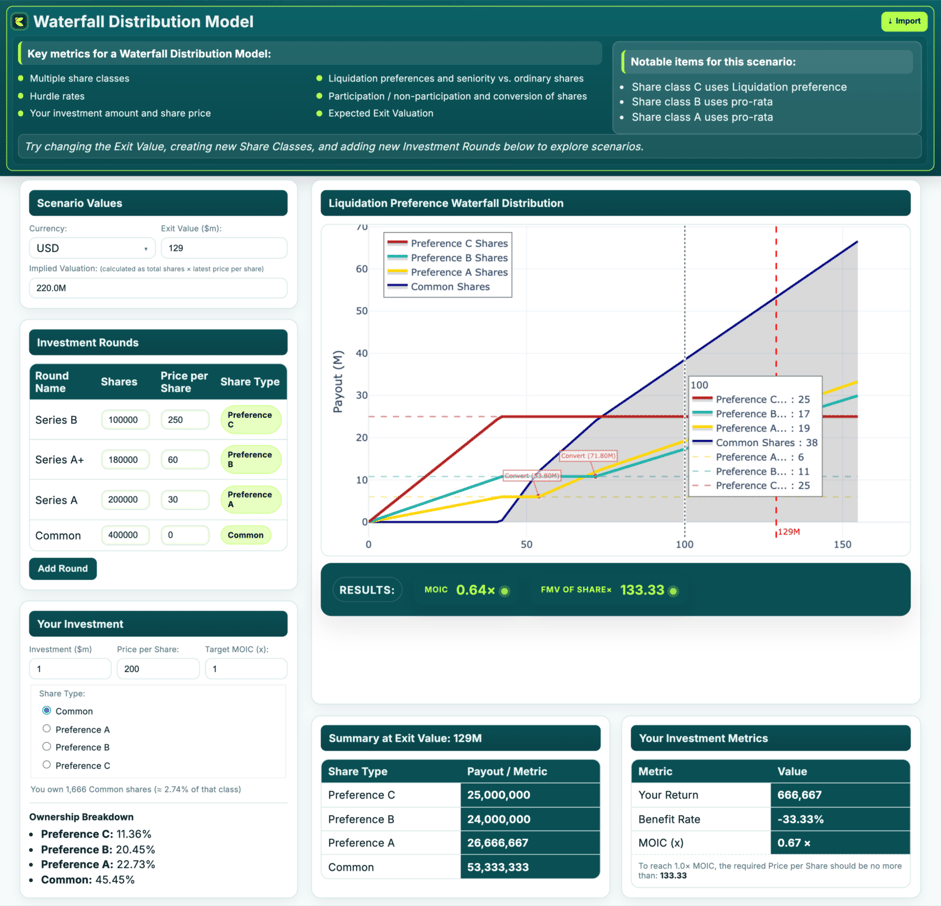

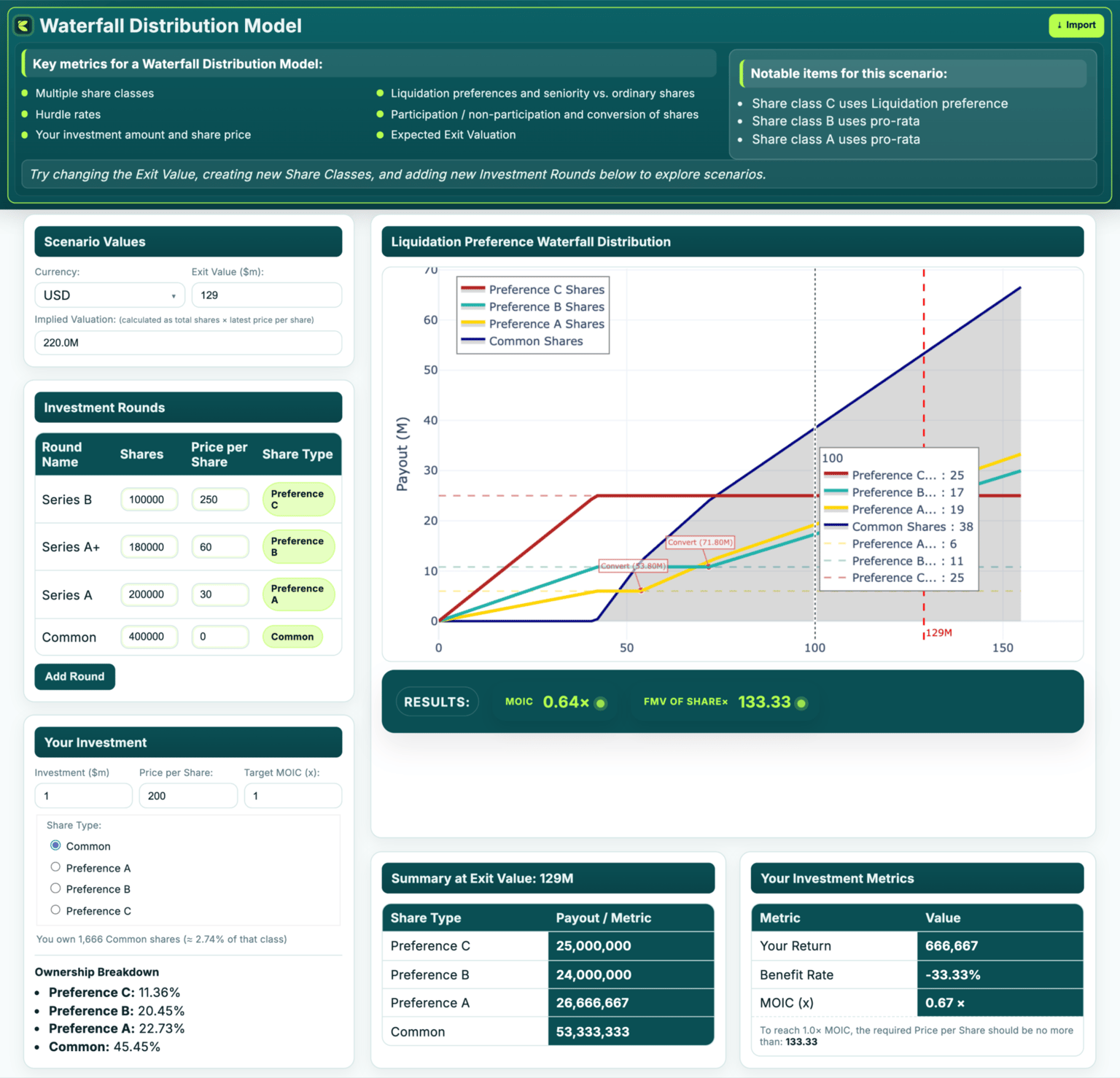

Payout Waterfall Simulation

Model exit distributions across different share classes and project your return on investment. Take into account complexities like Liquidation Preferences, Hurdle Rates, Seniority, and Pari Passu distributions.

- Preference Shares with Seniority and Liquidation Preferences

- Build your own model with custom defined share classes

- Simulate the return of your investment

- Calculate the Fair Market Value of a share

Prioritizing your Privacy and Security

At ReBloom, we prioritize the security and confidentiality of our users' information.

- Get access to our trusted, invitation-only Dark Pool environment where your positions and identity remain anonymous until introduction and transaction.

- Our privacy-focused Data Rooms allow sellers to securely upload and manage documents with full sovereignty.

- Our Access Control Management System offers sellers to briefly share partial deal related documents with NDA Integration, and buyers to request information by submitting a request for seller approval.

Market Due Diligence

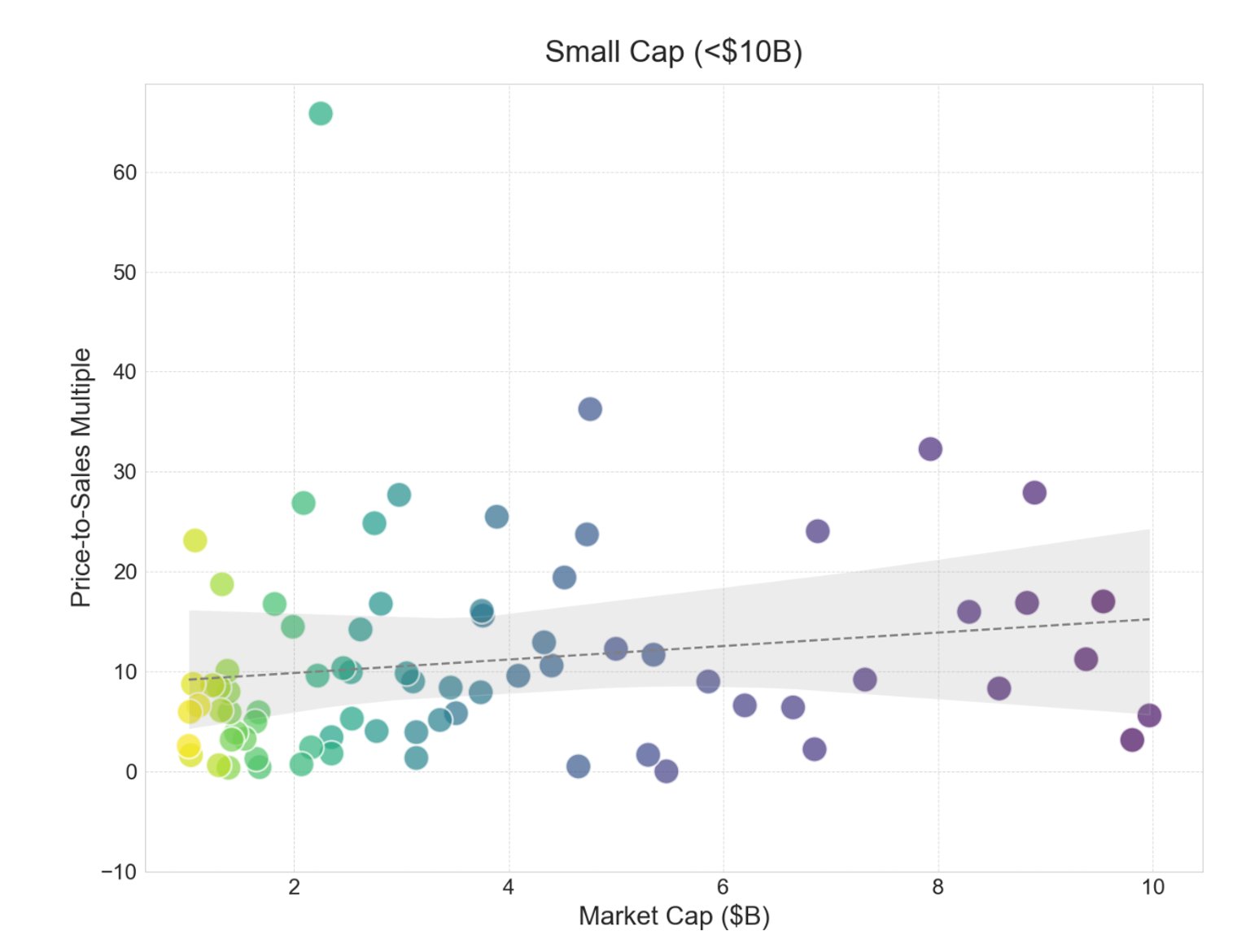

ReBloom provides comprehensive data for your market due diligence:

- State-Of-The-Art AI-Enabled Deep Research Agents for Market Report Generation.

- Waterfall Simulation Model for findings Fair-Market-Value of Assets.

- Market trends across various industries to give you accurate, up-to-date valuation metrics and sector-specific revenue multiples.

- Continuously updated proprietary Data Models to reflect the latest market conditions.

Global Access to Pre-IPO Secondaries

- Access Top-Tier Institutional Demand and Supply in the most sought after Private Market Assets.

- Strong Supply and Demand side catering to the top Institutional Investors globally.

- Full Anonymity and Confidentiality through our Dark Pool Environment.

REBLOOM

Media & Blogposts

FinTech ReBloom secures €600k to shake up private secondary trading. https://www.eu-startups.com/2025/02/fintech-rebloom-secures-e400k-to-shake-up-private-secondary-trading/

Danish fintech startup's €600K pre-seed fuels effort to make private stock trading more accessible. https://arcticstartup.com/rebloom-raises-e400ka-pre-seed/

ReBloom secures pre-seed investment for secondary trading platform. https://secondarylink.com/news/67aa373f83bc339ee25b09bd/rebloom-secures-pre-seed-investment-for-secondary-trading-platform

Secondary Market for Private Shares. https://rebloom.ai/blogpost/1751899139616x966430343910901200

The Emergence of GP-Led Secondaries. https://rebloom.ai/blogpost/1751899180494x421580097913075100

The New Frontier of Startup Secondaries. https://rebloom.ai/blogpost/1751899236742x779666029343801100

The Future of Private Market Infrastructure: Secondaries in 2025. https://rebloom.ai/blogpost/1764094610657x355518440326275650

The Waterfall Analysis: Foundation of Secondary Valuation. https://rebloom.ai/blogpost/1764094663219x330284631998110100

What Are Private Company Secondaries? https://rebloom.ai/blogpost/1767041206226x894077194251307800

How Technology Platforms Are Revolutionizing Private Company Secondaries in 2026. https://rebloom.ai/blogpost/1767098665448x733855434125423500

FAQs

Frequently Asked Questions

What is ReBloom?

- ReBloom is the leading infrastructure for Private Market Secondaries focused on institutional investors.

- ReBloom has access to the most sought after Pre-IPO assets with global institutional supply and demand.

- The platform offers institutional grade infrastructure for private markets such as our Dark Pool Environment for maximal privacy and confidentiality.

- The infrastructure is AI-enabled offering tools for due diligence such as modelling liquidation preferences across share class hierarchies, automated waterfall models for Fair Market Value discovery, market reports, and virtual data rooms.

What is a Dark Pool?

- The Dark Pool consists of vetted Institutional Investors with larger ticket sizes and with a requirement for full confidentiality on the details of their positions.

- The Dark Pool allows an investor to place a Bid or Ask for a specific private company without disclosing the Price, Ticket Size, Structure (Direct cap table, 1st/2nd Layer SPV), Fee Structure (Carry, Management Fee, Subscription Fee) or other details.

How do I get access to the Dark Pool?

- The Dark Pool is an invite-only vetted network of high volume institutional buyers and sellers of pre-IPO private company shares.

- To get accepted into the Dark Pool you can request access within the platform for the Dark Pool or by reaching out to the ReBloom team at [email protected] and schedule a call with us.

How can I join?

- Sign up on our website and get instant access. Fill out your investment profile and anonymously start exploring potential opportunities or potential buyers in the secondary private investment market.

- For institutional investors, request access to our invite-only Dark Pool environment from within the platform or reach out to us.

What is the Secondaries Market?

- The secondary market refers to the buying and selling of existing shares on a cap table in a privately held company.

- It provides liquidity to investors who want to exit their investments before the company has done an exit or for funds and institutional investors to rebalance their portfolio.

- It can be leveraged for investors to get onto the cap table of private companies that may not be accessible through primary investment rounds.

What are the Risks?

While investing in secondaries can be lucrative, it also comes with risks. These include the potential for loss of capital, lack of control over the underlying investments, and limited information about the portfolio companies..